Inside this issue

FROM THE EDITORS

COVER STORY

Irish Producer Finds Its Niche

PORTLAOISE, Ireland – On the outskirts of Portlaoise, Ireland sits the modest Laois Sawmills, in business since 1987, with a reputation for high quality, reliability and technical innovation. Just as the world has changed since its founding, so too has the mill company, Rory Roberts, shareholder and general manager says.

Article by Jessica Johnson, Managing Editor, Wood Bioenergy

IN THE NEWS

- Wood Bioenergy Conference Speakers Stepping Up

- USIPA Brings Industry To Miami

- Late 2022 Purchases Put Enviva In A Bind

- Highland Plans Pellet Mill In Grenada

THE WOOD YARD

EDITOR’S NOTE: The following companies submitted editorial profiles to complement their advertisements placed in the Wood Bioenergy December 2023 issue.

- CBI

- CW Mill

- Evergreen Engineering

- FMW Industries

- Fulghum Industries

- MDI

- Mid-South Engineering

- Morbark

- Precision-Husky

- Rawlings Wood Hog

- Sennebogen

- TerraSource

- West Salem Machinery

- BM&M

PRODUCT NEWS

- Bandit Industries Celebrates Big “40”

- BE&E Expands Products, Fabrication

- Captis Aire Receives EPA Chemistry Award

Find Us On Social

From the Editors

More Fiber For Energy?

An interesting report from the November issue of the Fastmarkets-RISI North American Woodfiber & Biomass Markets newsletter shows that in 2022-2023, a total of 21 wood bioenergy projects were announced in North America. These range from minimal expansions to the 2.5 million tons in annual usage projected for the Spectrum Energy pellet plant at Adel, Ga.

Altogether, if they pan out and get up and running, the 21 expansions and new plants are projected to consume roughly 9 million green tons of raw materials annually.

There are raw material opportunities out there for the wood bioenergy industry to investigate, thanks to an ongoing major shift in pulp and paper fiber usage in North America. Producers are moving away from extensive containerboard production—and also seeking to drastically reduce consumption of roundwood and chips as raw materials. Looking at closures of pulp-paper mills and machines the past four years, there’s lots of pulpwood looking for a home in certain timber baskets across the U.S.

According to the same issue of that newsletter, the pulp and paper industry is in the midst of a major supply side market shift. The most recent blow? International Paper in October announced a containerboard mill closure in Texas and permanent closure of pulp machines at mills in North Carolina and Florida.

In addition to affecting 900 jobs, the move eliminates an estimated 5 million green tons of wood fiber capacity across three mills. And the IP announcement is just the latest: Since January 2023, at least seven permanent U.S. mill or machine closures have been announced, according to North American Woodfiber & Biomass Markets newsletter.

The cumulative impact of pulp and paper facility closures across North America on the timber industry and its raw materials supply chain is historic and can’t be overstated, the newsletter states, as an estimated 15 million tons of roundwood and chip consumption have been taken off the market in 2023—about 17% of total wood consumption in 2022.

The newsletter notes that beginning with five announcements in 2020, during the past four years there’s been a total of 22 major U.S. pulpwood mill and machine closures that have taken a cumulative 30 million green tons a year in log and chip consumption off the market.

There are big implications for such a shift in demand that are just beginning to sink in as the supply chain adjusts. Will a significant percentage of the same pulpwood logs that were going to these facilities now find their way to wood bioenergy facilities?

From Left: Jessica Johnson, Managing Editor; Dan Shell, Senior Editor; Rich Donnell, Editor-in-Chief; David Abbott, Senior Associate Editor

The potential negatives are numerous, as shrinking markets lead to shrinking suppliers and shrinking investments into resources and infrastructure that serve those shrinking markets. For example, will large institutional landowners facing lower returns in those wood baskets suck it up and grow sawlogs or simply divest? Turn to carbon credits?

The resource feeding the closed pulp mills and machines is the same resource used for wood bioenergy: Lower quality and small diameter timber. How the wood bioenergy industry reacts to such an opening in raw material availability will be interesting to see.

As wood baskets across the country show, it’s important to have a significant segment of the industry able to have success consuming that lower-cost resource, whether it be pulp-paper, pellets, OSB-composites or something else. Add in a solid wood sector and you have all the ingredients for full utilization and sustainability of regional resources.

For the wood bioenergy industry, stepping in to expand where feasible by taking in the wood now looking for a new market is a natural extension of its mission to promote sustainability.

Irish Producer Finds Its Niche

Article by Jessica Johnson, Managing Editor, Wood Bioenergy

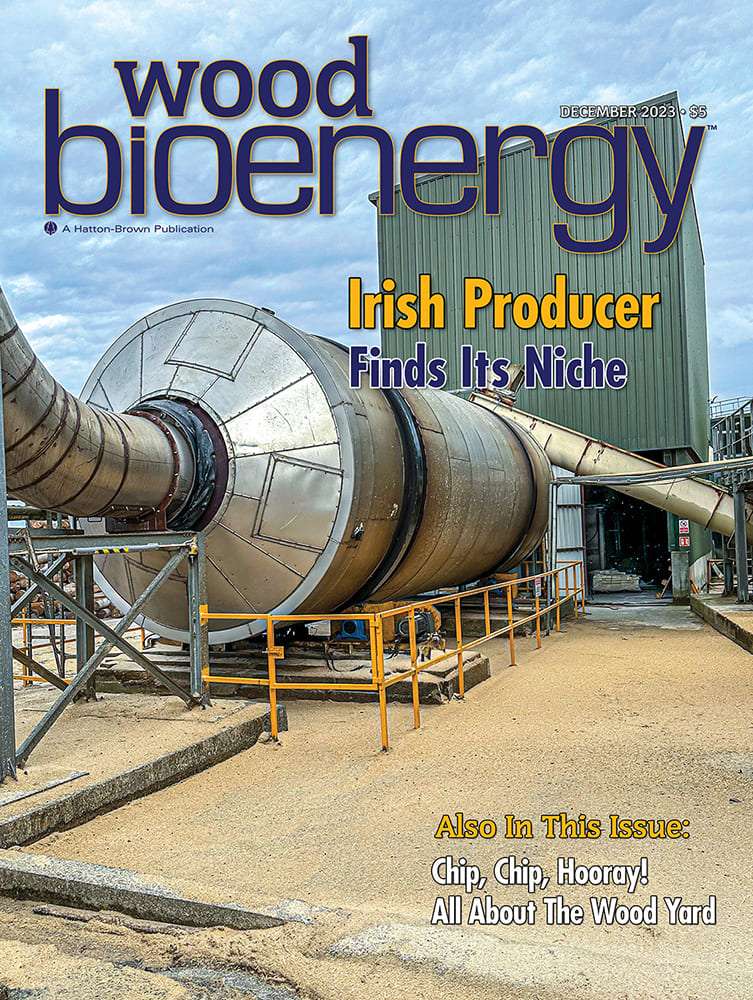

PORTLAOISE, Ireland – On the outskirts of Portlaoise, Ireland sits the modest Laois Sawmills, in business since 1987, with a reputation for high quality, reliability and technical innovation. Just as the world has changed since its founding, so too has the mill company, Rory Roberts, shareholder and general manager says. “We work hard,” he says of the 57-man team that staffs the facility with an annual turnover of 30 million Euros. One of the most notable of changes Laois Sawmills has seen is the addition of a 33,000 annual tonne pellet mill operation, known as Green Wood Pellets, which also produces dried wood chips.

PORTLAOISE, Ireland – On the outskirts of Portlaoise, Ireland sits the modest Laois Sawmills, in business since 1987, with a reputation for high quality, reliability and technical innovation. Just as the world has changed since its founding, so too has the mill company, Rory Roberts, shareholder and general manager says. “We work hard,” he says of the 57-man team that staffs the facility with an annual turnover of 30 million Euros. One of the most notable of changes Laois Sawmills has seen is the addition of a 33,000 annual tonne pellet mill operation, known as Green Wood Pellets, which also produces dried wood chips.

Around 10 years ago, management found themselves asking: “What are we going to do with our residues?” and thus, the Green Wood Pellets plant was conceived—serving the Irish and British markets with both bulk deliveries of a few tonnes for residual use and bagged options. But Laois Sawmills didn’t just invest in pellet production. Roberts estimates that over the last 12 years, more than 25 million Euros has been spent across the company, which includes a new debarking line and a new primary breakdown sawmill for its co-located sawmill.

The investment is critical, Roberts says, as was the diversification move into pellets. Especially important right now, as demand in Europe has declined for their green lumber fencing product. As a bright spot, “Pellets are okay,” he adds. “And back a bit in price but so are our costs. We have a good name for our pellets.”

Roberts also notes that one of the biggest things the company does is not skyrocket pricing in the winter or drop out the bottom in the summer. “We are in the middle, with mind on our customers,” he reiterates. A place that feels comfortable and keeps customers returning; it doesn’t hurt that Roberts is self-described as anal when it comes to tracking pellet production ensuring he can meet the needs of his recurring customers.

Want more content?

Wood Bioenergy is published and delivered 6 times per year to subscribers worldwide. Readership includes corporate executives, mill ownership, mill management, logging contractors and equity venture interests. Wood Bioenergy is FREE to qualified readers.

Latest News

John King Chains Celebrates 100th Year

John King Chains Celebrates 100th YearJohn King Chains Group is celebrating its 100th anniversary in 2026. Established in Leeds, England in 1926, the enterprise began by producing plain pedestal bearings for coal mining pit tubs. Expansion came with the rapid...

Weyco Wood Fiber Will Feed Aymium Biocarbon

Weyco Wood Fiber Will Feed Aymium Biocarbon Weyerhaeuser Co. and Aymium entered a memorandum of understanding (MOU) to partner to produce and sell 1.5 million tons of sustainable biocarbon annually for use in metals production. As an initial stage of this partnership,...

Webster Industries Purchases Renold

Webster Industries Purchases RenoldMPE Partners along with its portfolio company, Webster Industries, announced the closing of its acquisition of Renold plc, a leading designer, engineer, manufacturer, and supplier of premium, high specification industrial chain and...

Bioleum Corp. Acquires Hexas Biomass Inc.

Bioleum Corp. Acquires Hexas Biomass Inc.Bioleum Corp., which develops and commercializes technologies that convert lignocellulosic biomass into low-carbon fuels and refinery intermediates, has acquired Hexas Biomass Inc. Hexas is a global leader in the development...

PowerWood Canada To Build Two Black Pellet Plants In Northern Alberta

PowerWood Canada To Build Two Black Pellet Plants In Northern AlbertaPowerWood Canada Corp., headquartered in Calgary, has progressed its plans to build two steam-exploded black pellet production facilities in Northern Alberta for the Japanese power plant market. The...

Japan Brings 112 MW Biomass Power Plant On-Line

Japan Brings 112 MW Biomass Power Plant On-LineThe Sendai Port Biomass Power Plant has begun commercial operations in Miyagi Prefecture, ranking among Japan's largest dedicated biomass power facilities with an output of 112 MW. The plant is expected to generate...

Subscribe to Our Newsletter

Wood Bioenergy News Online hits the inboxes of subscribers in the wood-to-energy sectors.

Subscribe/Renew

Wood Bioenergy is published and delivered worldwide 6 times per year. Free to qualified readers in the U.S. Subscribers outside the U.S. are asked to pay a small fee.

Advertise

Complete the online form so we can direct you to the appropriate Sales Representative.